CoreWeave’s journey from crypto mining to large-scale AI infrastructure underscores a broader trend in tech: the recycling of computing power across innovation cycles.

According to a recent newsletter from The Miner Mag, Ethereum’s transition away from proof-of-work sharply reduced demand for GPU-based mining. That shift forced operators like CoreWeave to rethink their business models, redeploying surplus hardware toward AI training and other high-performance computing workloads just as global demand for compute power began to surge.

As previously reported by Cointelegraph, CoreWeave started stepping away from crypto mining as early as 2019. The company initially pivoted into cloud services and high-performance computing before fully repositioning itself as a dedicated GPU infrastructure provider for AI.

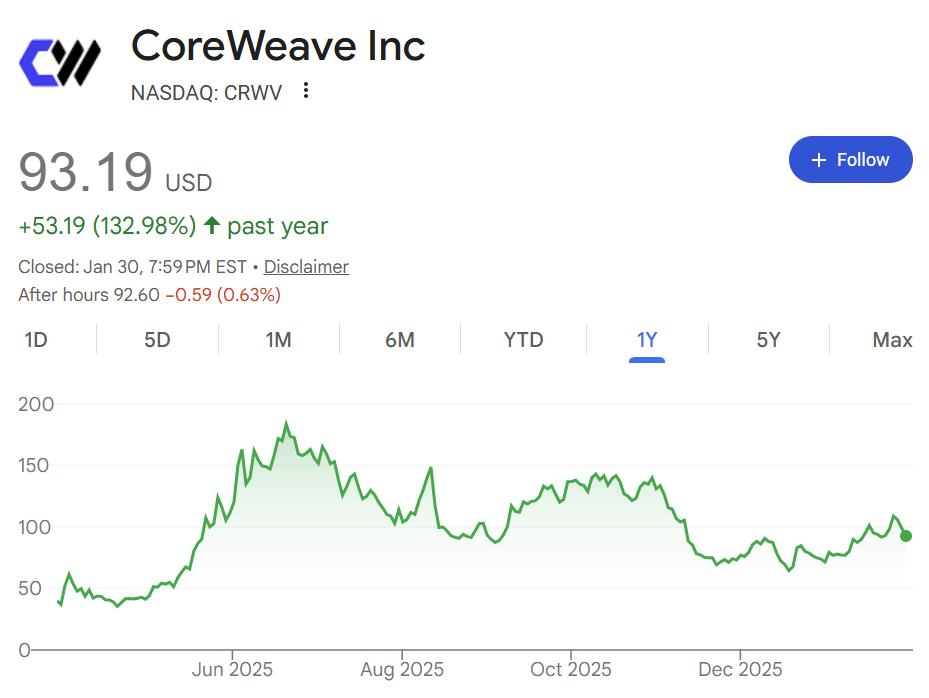

That strategic shift has accelerated rapidly. Nvidia recently committed a $2 billion equity investment in CoreWeave, a deal that The Miner Mag said cemented the company’s status as one of the largest independent GPU infrastructure operators outside the dominant cloud giants.

The company’s expansion has also delivered substantial financial returns for insiders. Since its IPO in March last year, CoreWeave executives have reportedly generated around $1.6 billion in proceeds from stock sales.

From crypto mining to AI data centers

CoreWeave is not alone. Several former crypto miners—including HIVE Digital, TeraWulf, Hut 8, and MARA Holdings—have successfully transitioned into AI and high-performance computing by repurposing energy assets and data center infrastructure originally built for mining operations.

Yet the AI data center boom is beginning to echo challenges once faced by Bitcoin miners. As Cointelegraph recently noted, growing resistance linked to power consumption, grid pressure, and land use is emerging in regions hosting large AI facilities.

Still, the market remains highly dynamic. Bloomberg data, citing research firm DC Byte, shows thousands of new players entering the data center space. By 2032, Big Tech’s share of global computing capacity could drop below 18%, pointing to a more fragmented and competitive ecosystem.

If this trajectory continues, AI data centers—much like crypto mining operations before them—may increasingly operate beyond the direct control of major technology firms.

Source: tradingview Edited By Bernie